In today's fast-paced digital age, e-commerce has emerged as a driving force in the world of retail, and Amazon reigns supreme as the ultimate online shopping destination. With millions of customers worldwide and a staggering array of products, becoming an Amazon seller can be a game-changer for your business. But where do you start on this exhilarating journey into the world of online retail?

Welcome to our comprehensive guide on creating an Amazon Seller Central account—your gateway to a global audience and unparalleled selling opportunities. Whether you're a budding entrepreneur with a unique product or an established business looking to expand your reach, this blog is your roadmap to success.

Unlock the potential to showcase your products to a vast and diverse clientele, harness powerful marketing tools, and tap into Amazon's seamless logistics through this step-by-step exploration. We'll walk you through the intricacies of setting up your seller account, from gathering the necessary documents to navigating Amazon's policies and guidelines.

Prepare to embark on a transformative adventure into the heart of e-commerce. Join us as we delve into the world of Amazon Seller Central, demystifying the process and equipping you with the knowledge and confidence to thrive in the competitive digital marketplace. Your journey to becoming an Amazon seller begins here.

We will walk you through the process of setting up your Amazon Seller Central account in India, covering everything from GST registration to setting up an Amazon account.

Understanding the Indian E-Commerce Landscape

Before diving into the details of setting up your Amazon Seller Central account, it's crucial to have a solid understanding of the Indian e-commerce landscape. India has witnessed a significant surge in online shopping, driven by factors such as increasing internet penetration, smartphone usage, and a growing consumer base.

Amazon, being a major player in the Indian e-commerce market, offers sellers a unique opportunity to showcase and sell their products to a diverse and vast audience. However, navigating the platform requires a strategic approach and a clear understanding of the local market dynamics.

Creating a seller central account involves two major steps:

- Step One: Setting up your Company

- Step Two: Creating Amazon Seller central account in Amazon

You will need the following information to register as a seller on Amazon:

- Your company details

- Your contact details: email and phone number

- Basic information about your business

- GST Details are mandatory and need to be provided after registration

- Bank Account

Your company details are your company’s legal name, address, and contact details.

Basic information about your business is what kind of products your company deals with. For example: cell phone accessories, kitchenware, etc.

Step One: Setting up your Company

There are three major types of business entities available in India.

- Public Limited Company

- Private limited Company

- Sole Proprietorship or Partnership Company

Public Limited company

A Public Limited Company is a company limited by shares in which there are no restrictions on the maximum number of shareholders. It can offer its shares or debentures to the public, can make or accept deposits from the public, and there are no restrictions on the transfer of shares. The liability of each shareholder is limited to the extent of the number of shares subscribed. However, the liability of a Director / Manager of such a company can sometimes be unlimited.

The minimum number of shareholders is seven, and there are three directors. It also has a minimum share capital requirement of Rs. 500,000. A Public Limited Company should be registered with the Registrar of Companies (RoC) of the respective state under The Companies Act, 1956. Although the registration with RoC is at the state level, it is free to do business anywhere in India.

This is very complicated to start with; at this point, we don’t need anything of this kind.

Private limited Company

Private Limited Companies are those types of companies where the minimum number of members is two and the maximum number is two hundred. A private limited company has a limited liability to its members, but at the same time, it has many characteristics similar to those of a partnership firm.

A private limited company has all the advantages of a partnership firm, namely, flexibility, a greater capital combination of different and diversified abilities, etc., and at the same time, it has the advantages of limited liability, greater stability, and a legal entity. In this sense, a private limited company stands between a partnership and a widely owned public company. Identifying marks of a private limited company are name, number of members, shares, formation, management, directors, meetings, etc.

The maximum number of directors shall be mentioned in the Articles of Association. In the grand scheme of privileges and exemptions, the Companies Act distinguishes between an independent private company and another private company that is a subsidiary of the other public company.

This type of entity may be considered once you have established your business on Amazon and have a turnover of more than one crore annually.

Sole Proprietorship or Partnership Company

Registration is not required for a sole proprietorship entity. But if you are liable for state GST registration, you need to obtain GST registration. For sole proprietorships, a separate income tax, or PAN, is also not necessary. The PAN of the proprietor can be the PAN of the firm and proprietor, and it can be under a personal name as well. There are plenty of places you can find information on how to get your PAN card.

For partnership firms, it is not necessary to register with the government in most states of the country. It is almost compulsory in Maharashtra. Please check the laws in your state to confirm.

But if you are not registering your partnership firm, you cannot hire legal protection in disputes between partners. Even if you choose not to register your partnership, always prepare a partnership deed, which will help to resolve problems in the case of disputes between partners. Partnership deeds can be prepared by any lawyer and made on stamp paper as per the laws of the place of execution.

For registration of a partnership firm, partnership deeds need to be prepared along with an application in the required form, and both should be submitted with supporting documents at the nearby “Registrar Of Firms” office for approval.

I suggest you go with a sole proprietorship firm, which does not require any registration, but you need to obtain your GST.

Getting GST:

- You can obtain a GST certificate within a week.

- You need to get your PAN done before GST

- You can contact a local accounting firm for assistance.

- If you choose to apply independently by following online tutorials

- Government fees for the GST certificate amount to approximately Rs.500 DD (Demand Draft).

- Hiring an accountant for the same process may cost between 2000 to 2500 rupees.

- Fees may vary depending on your location.

- The accounting firm will guide you through the entire process.

- Regardless of whether your revenue is less than 10 lakhs or 20 lakhs, for e-commerce, having GST is mandatory, even if your revenue is as low as one rupee, unless your product qualifies for GST exemption.

After completing the GST process, you can proceed to open a current account at any bank located near you.

Step Two: Creating an Amazon Seller Central account

The first step towards establishing your presence on Amazon India is to register for a Seller Central account. Follow these steps to get started:

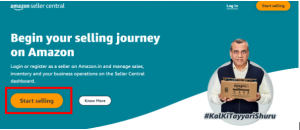

To set up your account on Amazon Seller Central, simply go to your browser and type https://sellercentral.amazon.in/ and it'll bring you to this page. Follow the step-by-step process.

![]()

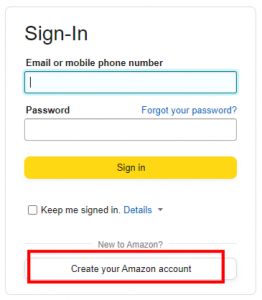

![]()

![]()

![]() If you already have an Amazon account, use your login credentials to sign in, or you can open a new account.

If you already have an Amazon account, use your login credentials to sign in, or you can open a new account.

![]() It involves five steps. Add all the details carefully.

It involves five steps. Add all the details carefully.

Once you have provided all the required information, you are now registered to sell on Amazon.

Creating a Seller Central account on Amazon is not just about starting a business; it's the beginning of a journey. As sellers gain experience, explore new avenues, and scale their operations, they contribute to the vibrant tapestry of Amazon's marketplace.

The platform offers the resources and infrastructure for sellers to dream big, evolve, and realize their business aspirations.

In essence, the process of creating a Seller Central account on Amazon transcends the technicalities of registration. It symbolizes the democratization of commerce, the elevation of entrepreneurship, and the fusion of innovation with tradition. Whether you're a seasoned entrepreneur or a newcomer with a unique product, Amazon's Seller Central beckons, inviting you to join the ranks of global sellers shaping the future of online commerce.

As you embark on this journey, may your endeavors be fruitful, your strategies innovative, and your success reflective of the boundless possibilities that Amazon's marketplace affords.